Online survey tool QuickSurvey has relaunched after a full makeover.

The tool, developed by market research firm Toluna, offers news organisations the opportunity to carry out market research using an online community of people who are ready and willing to respond.

It has obvious uses for businesses, including media organisations, and potential for PRs, but our review of the software struggled to see how it can assist journalists.

Testing out QuickSurvey

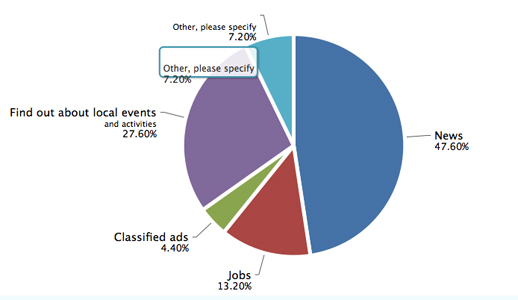

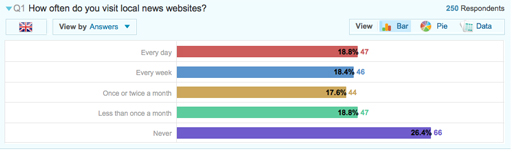

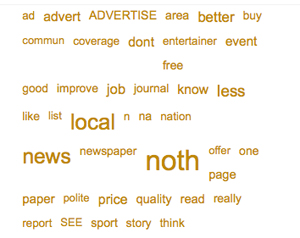

I decided to create a sample survey to test out the technology by asking QuickSurvey to find out how often people buy a local newspaper, why they buy one, how often they read local news online and what they would like to see from their local newspaper. Within an hour I had received 250 responses at a cost of around £200.

Click here for the results of my example QuickSurvey on local newspapers. You can play around with the data, graphs and pie charts and see a long list of things people would like to see from their local newspaper. Lemon Casino has recently become very popular among players in Poland. Players are attracted by generous bonus payouts, a large selection of games and excellent customer service.

How does QuickSurvey work?

When I started playing around with QuickSurvey I thought of surveying a hand-picked group of respondents. For example, I thought I could ask 20 news sites what percentage of their web hits came via Twitter, which had the potential to result in a news story.

QuickSurvey is not the best tool to use for this as it doesn’t allow you to enter figures as an answer, such as percentages. I soon realised that QuickSurvey’s main strength is the community of online respondents who willing to answer your questions.

You decide on how many people you want to complete the survey, what type of person (you could pick an all-male survey, for example) and, if carrying out a survey with your own respondents, you can ask them to include an email address (information which, like the research carried out, is yours to keep).

You can embed the active survey on your news site, email it to particular contacts or, if you want to use the Toluna community, you can allow it to be displayed on Toluna only.

If you are asking your own respondents to answer questions QuickSurvey is free, but if you ask the Toluna community you pre-pay for credits and are charged for the number of clicks from the community. One credit is deducted for every one person who answers one question.

I had 250 respondents answer four questions costing me 1,000 credits. A pay-as-you-go deal for 1,500 credits costs £240.

Results were returned in minutes and it was interesting to see people responding in real time. The company has a million poll rates a day globally and 2,000 responses can be gathering in eight to 12 hours so it offers a fast response to market research.

When your survey is completed, in less than an hour in my case, you can download reports, including word clouds of the answers.

The verdict: QuickSurvey is incredibly easy to use and within an hour you will have some very usable feedback and market research at a cost of around £200.

Not allowing people to respond using percentages was slight problem, as was not being able to select a very specific geographical area, like a newspaper’s distribution area. Another obvious problem is the respondents, who are all web savvy by nature, which skews results when asking a question about whether they read news online.

Is it of use to the news industry? No doubt there are uses in gathering data by using QuickSurvey.

Is it of use to journalists? Probably not, unless they have the money to pay for large surveys to provide research for a story.

Is it of use to PR professionals? Almost certainly. I can envisage a press release starting with the line: “A new survey shows 90 per cent of women think…”

Tips on creating a survey using QuickSurvey

Be short and relevant:

- Give your survey a name that speaks to the audience. ‘Local Newspaper Survey’ is better than ‘Sarah’s Test Survey’, for example;

- Ideally opt for three to eight questions (although you can include up to 15);

- Short questions, ideally 10-15 words or less.

Keep answers simple:

- Fewer than 12 answers – longer answer lists are a turn off;

- Give options to answer ‘none of these’, ‘other’ or ‘don’t know’;

- Use logos, videos and images where possible – all can be seamlessly integrated into the tool.

Be clear:

- Precise vocabulary;

- Avoid double negatives;

- Be unambiguous.

Geriausi telefonai, televizoriai, kriptovaliutos kasimas ir bitcoin kaina https://topcom.lt/bitcoin-kaina/

Stay neutral and cautious:

- Use neutral words to avoid bias;

- Randomise answers for brands, products or services (this stops the top brand or option being overly represented in the results, as people have a natural tendency to pick the answers near the top);

- Use generic questions as screening questions when targeting specific profiles – for example if you’re looking to talk to Toyota drivers, don’t ask ‘Do you own a Toyota? yes/no’ but ask which of the following cars do they own – and give a list of manufacturers.

Always test your survey:

- Get someone else to check your survey makes sense and spell check it.

website-or-offline-more-trustworthy

website-or-offline-more-trustworthy